Buy Gold TodaySecurity against Inflation

Gold is not used as a currency today, but its role as money dates back thousands of years and makes it superior to any currency. In fact, gold has outlasted every currency in history.

In this time of history, we can see that the U.S dollar could lose its value as also all the other currencies; in fact, one of the goals of the central bank is to introduce the digital currency.

Furthermore, the consequences of the pandemic, the war with all his sanctions and the printing of more money is leading to high inflation and high national debt.

securitydiversificationoutside banking system

On 15 August 1971, the U.S dollar left the gold standard, so the United States terminated the convertibility of the US dollars to gold and made the dollar a fiat currency, and shortly other currencies, such as the pound sterling become free-floting.

Money is just only paper and numbers! This means that your savings are at risk!

Today you need an alternative asset for saving diversification, and many people are turning to precious metals to diversify their accounts and savings because precious metals are universally the best assets with a good long-term value.

Owning physical gold and silver coins, bars or bullion is the best option because is detached from the financial market, from the institutions and is outside the digital system.

Gold has been the representation of wealth worldwide for thousands of years and throughout history has shown the capacity to grow in value during periods of economic crisis. The good news is that gold has the potential to increase in value due to a variety of influences, including the devaluation of the dollar and other currencies and also the high demand for precious metals.

How to store gold safely?

Gold Price

Past performance does not guarantee future results but owning precious metals is one of the best options to diversify your assets and savings.

🥇 Best leaders in the precious Metals Industry

Gold Avenue

Gold Avenue provides a secure and reliable online platform for purchasing and safeguarding physical gold. As an authorized online distributor for the MKS PAMP GROUP, a reputable Swiss family entity in the precious metals sector, Gold Avenue is a trusted choice for those interested in gold investments.

A unique advantage offered by Gold Avenue is its fully allocated storage solution, independent of the traditional banking system. The precious metals, including bars and coins, stored in Gold Avenue’s vaults are fully insured against theft, loss, and damage, offering investors peace of mind.

In addition to these features, Gold Avenue offers three storage options. Storage for holdings up to £8,500 is provided for free, while a cost-effective option of £8 per month is available for holdings up to £85,000, which includes three months of free storage. For holdings exceeding £85,000, a nominal fee of 0.5% per year is charged, with personalized pricing tailored to your portfolio and the support of a dedicated key account manager. Furthermore, it’s worth noting that storage for precious metals valued up to $10,000 is offered at no cost.

BullionVault

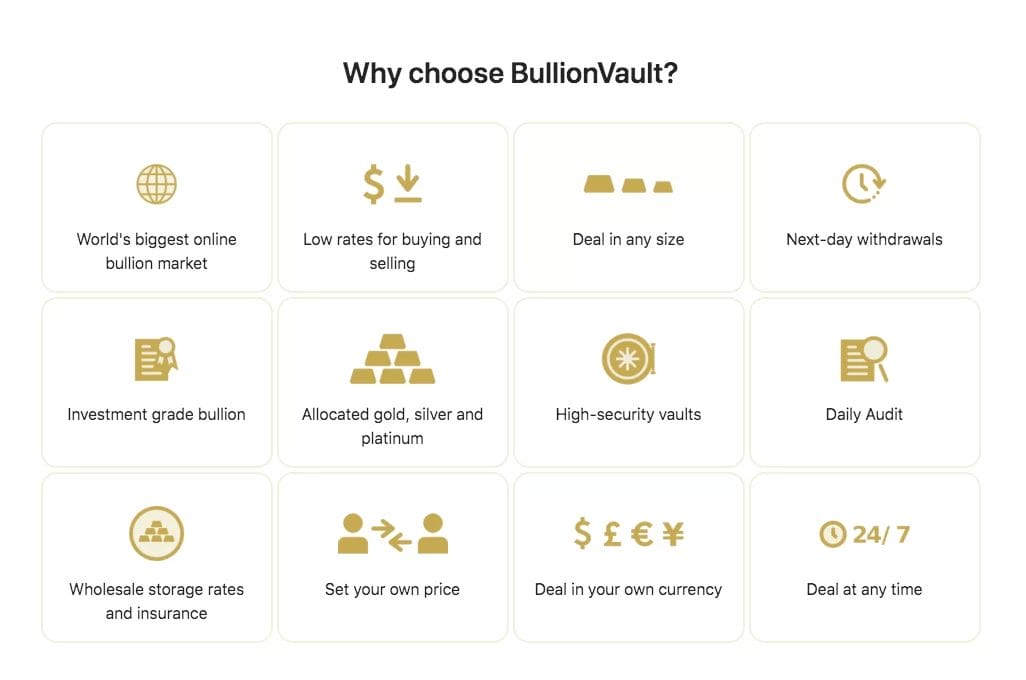

BullionVault stands out as the premier online platform for private investors seeking seamless access to professional bullion markets. With a commitment to providing the lowest costs for buying, selling, and storing gold, silver, platinum, and palladium, BullionVault has emerged as the world’s largest online investment gold service, overseeing a staggering $4.1 billion in assets for over 100,000 users globally.

One of BullionVault’s key strengths lies in its strategic partnerships, being part-owned by both GBIT and Augmentum Fintech plc. This collaboration ensures a robust foundation, allowing users to transact with confidence and security.

The platform offers the flexibility to store precious metals in top-tier vaults located in Zurich, London, Toronto, Singapore, or New York, giving investors the autonomy to choose the preferred storage location. Thanks to BullionVault’s substantial size, users benefit from exceptionally low storage costs, which always include comprehensive insurance coverage.

What sets BullionVault apart is its simplicity and speed. Investors can own physical gold and silver bullion almost instantly, with the freedom to sell at any time without penalties. Withdrawals and wire transfers are processed promptly, ensuring a seamless and efficient experience.

BullionVault manages an impressive $4.1 billion in bullion and assets, including a substantial $3 billion worth of gold—surpassing the gold reserves of many countries. The platform charges a maximum of 0.50% for buying or selling gold, silver, platinum, or palladium on the live order board, with reduced fees for transactions exceeding $75,000.

Investors benefit from direct dealings with other users, allowing both parties to quote prices and cut out intermediaries, thereby reducing transaction costs. BullionVault supports transactions in Euros, Pounds Sterling, Japanese Yen, and US Dollars, enabling users to avoid the high costs associated with currency conversions.

Crucially, BullionVault exclusively deals in allocated gold, silver, platinum, and palladium, ensuring that investors own their bullion outright, with legal ownership clearly established. The platform’s commitment to transparency is underscored by its daily online audit, reconciling users’ precious metals holdings with third-party Bar Lists.

With insurance and storage costs at a mere 0.12% per annum for gold—significantly lower than typical annual management fees charged by most ETFs—BullionVault proves to be an invaluable resource for investors seeking a reliable, cost-effective, and secure avenue for precious metal investments.

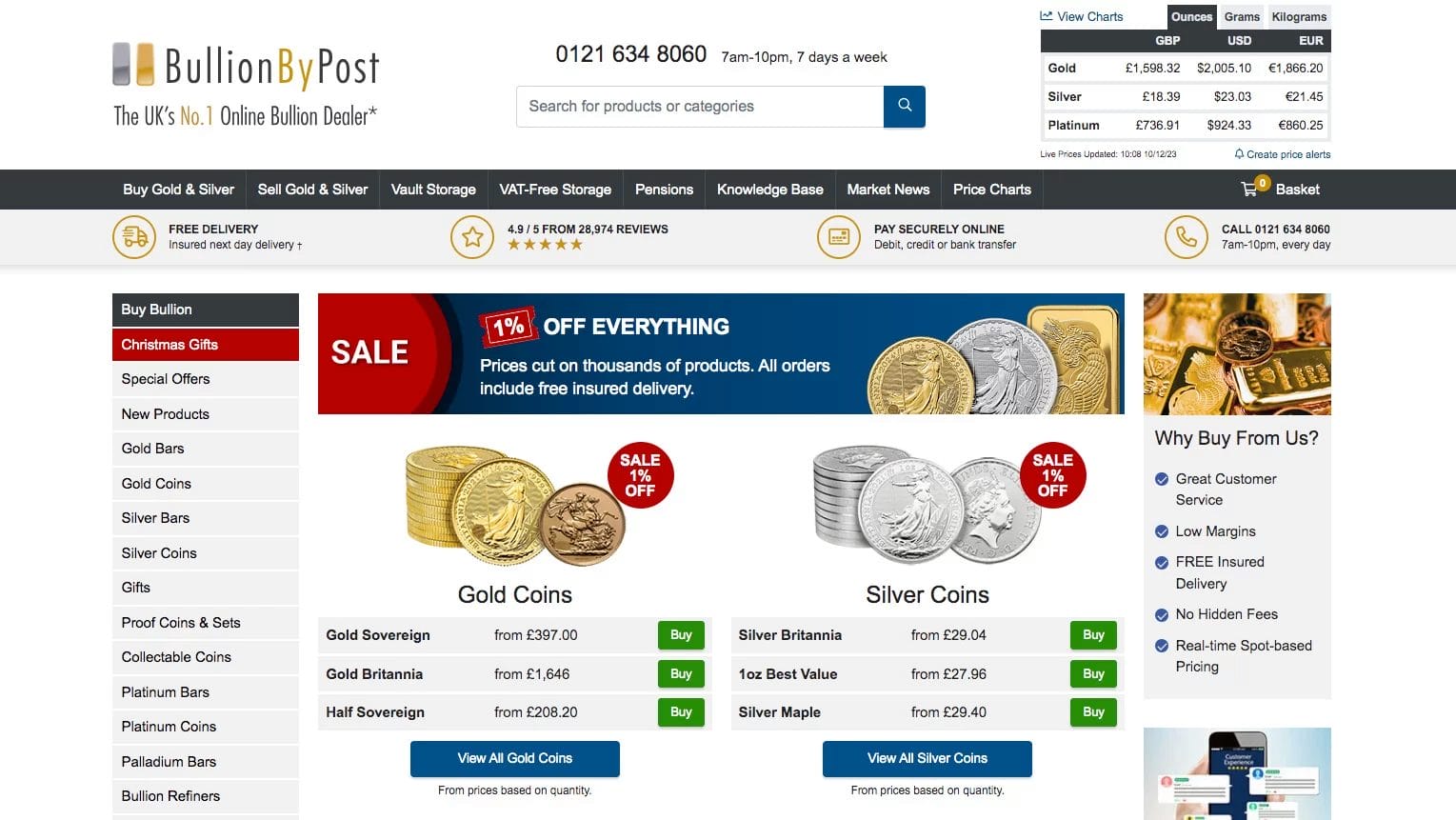

BullionByPost

BullionByPost, a service offered by Jewellery Quarter Bullion Limited based in Birmingham, provides a secure and straightforward platform for private UK investors to purchase various bullion products at low margins, ideal for investments. The company offers a comprehensive range of bullion items, including gold and silver bars, coins, platinum, and palladium products. They are an authorized distributor of LBMA-approved bullion from reputable sources such as Umicore, Heraeus, PAMP Suisse, and others, as well as a Royal Mint authorized bullion distributor.

Jewellery Quarter Bullion, the parent company of BullionByPost, has received several awards for business growth and performance over the years. These awards, sponsored by The Sunday Times and based on data from Fast Track, include recognition in categories like Fast Track 100, Profit Track 100, Top Track 250, and International Track 200.

BullionByPost ensures the security of its deliveries by offering free fully insured delivery on all orders, with discreet packaging and optional tracking for orders over £250. The company also provides allocated secure storage in collaboration with Brink’s of London, allowing customers to securely store their bullion with the flexibility to request delivery or sell their holdings at any time.

For specific products like VAT-Free silver Britannias and 1 Kilo bullion bars, BullionByPost offers dynamic storage in Zurich, facilitated by Loomis on a secure site. Unlike the UK storage options, these bars are not held in individual consignments, enabling faster trading for investors.