FreeAgent accounting software is the best and simple software for invoicing, quotations, project tracking, payroll, VAT returns, Corporation tax, End of Year filing, and Self Assessment.

If you have a company or just you are Sole Trader or Landlord FreeAgent can save you time and money!

FreeAgent Review: FreeAgent is simple and straightforward to use.

The main features are:

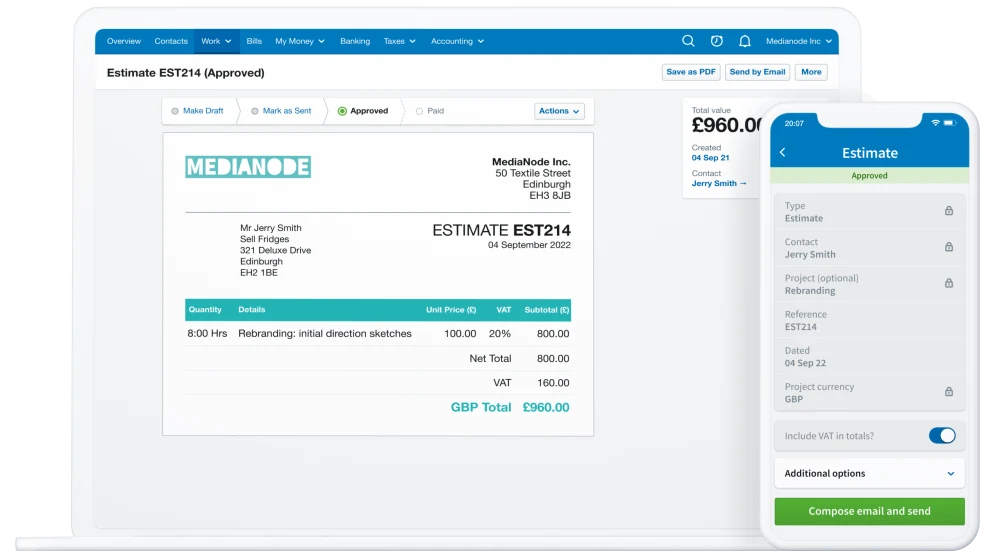

With FreeAgent you can create estimates in minutes:

With FreeAgent, you can create and send professional invoices and get paid faster, thanks to the different templates done for you.

Furthermore, through an invoice, you can get paid by credit/debit card, direct debit, and PayPal, and also FreeAgent chase late payer through automated email reminders.

FreeAgent Discount Code = 4ip82cra Use our FreeAgent Referral Code and get 10% off on your subscription for LIFE

Capture and record all your receipts

With FreeAgent you can snap expense receipts and upload them to your account from your phone, can plan ahead with a clear view of upcoming recurring expenses, and divide the expenses into categories.

With FreeAgent, you may be tracking all the income and expenses of your projects

FreeAgent Discount Code = 4ip82cra Use our FreeAgent Referral Code and get 10% off on your subscription for LIFE

With FreeAgent you can track every minute of the time you spend on projects with a simple time-tracking software:

FreeAgent is fully-integrated with a payroll software, including the RTI submissions to HMRC.

FreeAgent is fully-integrated with a payroll software, including the RTI submissions to HMRC.

FreeAgent Discount Code = 4ip82cra Use our FreeAgent Referral Code and get 10% off on your subscription for LIFE

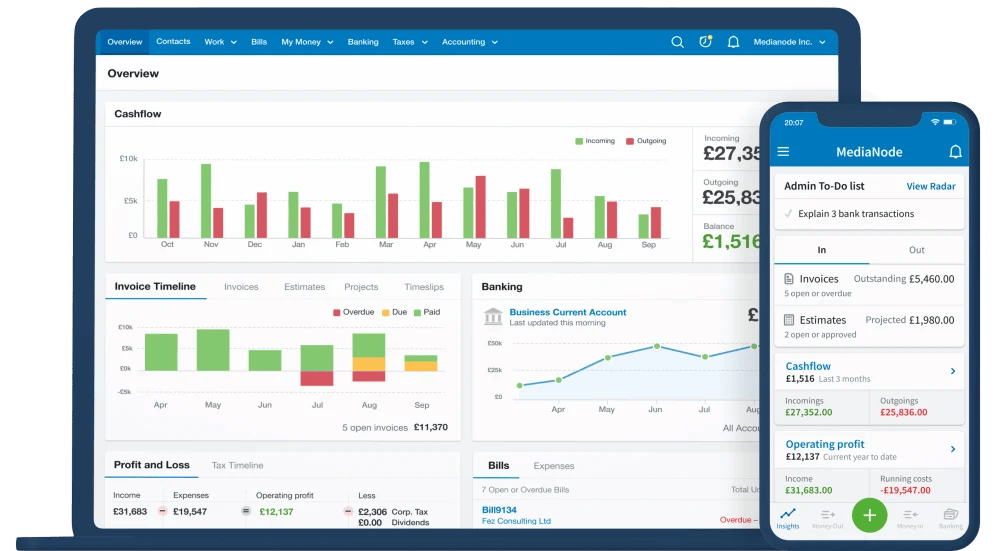

Bank Feed: Connect your bank account to FreeAgentWith FreeAgent, you can track your business’s incoming and outgoing automatically.

FreeAgent lets you see 90 days ahead into your predicted cashflow future

FreeAgent’s Cashflow calculation is updated automatically based on the data in your account. Is a smart tool to predict your spending and also receiving, including actions like chasing an overdue invoice or paying an upcoming bill.

Automated accounting and bookkeeping with FreeAgent

FreeAgent automatically builds real-time business accounts from the bank statements, invoices, and expenses that you enter throughout the year.

Create financial reports like profit and loss, balance sheet, trial balance, aged debtor and creditors reports, dividend reports, and printable dividend vouchers.

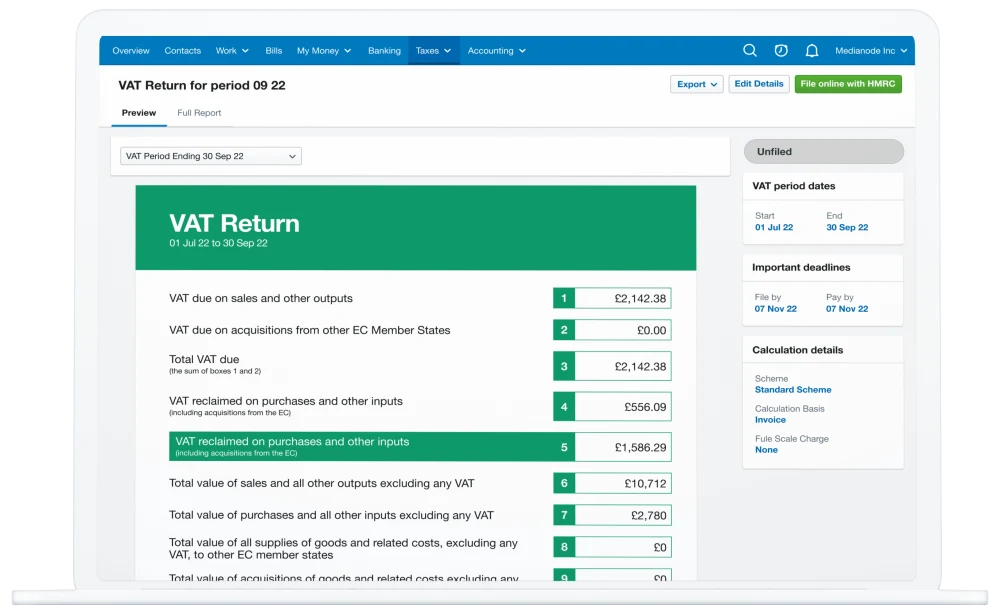

With FreeAgent you generate your VAT returns automatically as you do your books.Yep, FreeAgent automatically generates your MTD-compatible VAT returns, and lets you submit them online directly to HMRC ( and also reminds you when payment is due)

FreeAgent Discount Code = 4ip82cra Use our FreeAgent Referral Code and get 10% off on your subscription for LIFE

Self Assessment: Complete your tax return online in a few minutes

Yes, with FreeAgent you’re going to know how much tax you own and when you own it, without missing a deadline. Furthermore, you can calculate your Self Assessment liability, prepare your tax return and submit it directly to HMRC. Sound like magic, but is really simple!

Here at MoneyZoe with love FreeAgent, because is simple and has great features It has saved us so much time and money!

So if you are a Sole Trader or have a Limited Company, FreeAgent is the best choice, so you can focus more on your business and less on bookkeeping and accounting!

Sign-up with our FreeAgent discount code and get 10% off your FreeAgent subscription – for life!

Try before you buy – you’ll get a free FreeAgent 30 day trial – no credit card required.

(FreeAgent Discount Code: 4ip82cra)

FreeAgent Discount Code = 4ip82cra Use our FreeAgent Referral Code and get 10% off on your subscription for LIFE

Guide about Self Assessment: When and How to Register

With FreeAgent, you get your Self Assessment ready in just a few minutes!When to register for Self Assessment

You have to register for Self Assessment with HMRC if you need to send a tax return and you did not send one last year. The deadline for registering for Self Assessment is the 5th October that follows the end of the tax year that the Self Assessment tax return you’re filing relates to. For example, if the tax return relates to the tax year starting 6th April 2021 and ending 5th April 2022, you should register for Self Assessment by 5th October 2022. If you don’t register by the appropriate deadline, you could be fined!

PS: If you registered for Self Assessment and filed a tax return last year, you don’t need to register again.

How to register for Self Assessment

Registering if you’re self-employed: If you’re self-employed, here’s what you need to do if you’re required to register for Self Assessment. For more information checkout HMRC website.

If you already have a business tax account, you can register by signing in to this account and adding Self Assessment to your list of services. You’ll need a Government Gateway user ID and password in order to to sign in to your business tax account.

If you don’t have a business tax account or a Government Gateway user ID, select ‘Create sign in details’ link on the login page and follow the instructions.

You should receive a letter from HMRC with your Unique Taxpayer Reference (UTR) number within 10 working days (21 days if you live abroad). You should also receive a separate letter within seven working days with an activation code for your business tax account. You can retrieve a lost UTR number or get a new activation code from HMRC if you lose either of them after they arrive.

Once you’ve received your UTR number and activation code, you can log in to, and activate, your business tax account. Once you’ve done this, you should be able to add Self Assessment to your list of services and file your tax return.

End of Year Filing for UK limited company

With FreeAgent you can File Final Accounts (FRS 105 micro-entity report) directly to Companies House and File the Corporation Tax (CT600) returns directly to HMRC.

Limited companies need to file to Companies House and HMRC at the end of every accounting year and without an accountant can be overwhelming, difficult, and time-consuming, but with FreeAgent, your final accounts report will be automatically generated, and also your Corporation Tax.

In fact, FreeAgent software, after filing the account to Companies House will generate the CT600 from your account, with most of the boxes pre-filled, and file it directly to HMRC.

The form is supported for most micro-entities and includes trading profits (or losses), capital allowances, non-tax-deductible expenses, a tax calculation, and more.