Maximizing Your Returns: Understanding Dividend Payments and Tax Implications

by Chris M.

May 30, 2024

by Chris M.

May 30, 2024

When managing dividend payments and tax considerations, it’s important to understand that dividends are taxed differently from regular income, often at a lower rate. Before issuing dividends, it’s crucial to verify the availability of distributable profits and accurately calculate them from your financial statements. Seeking advice from a financial professional can help you ensure compliance with legal requirements and optimize your tax position. However, it’s essential to know how to maintain precise records, prepare dividend vouchers, and document board meeting minutes effectively to stay on track. Let’s delve into the key steps involved in handling dividend payments and tax considerations effectively.

To begin with, it’s crucial to confirm that your company has distributable profits available for dividends. Distributable profits are the accumulated profits that can be distributed to shareholders as dividends. These profits are calculated based on your company’s financial statements, specifically the profit and loss account and balance sheet. By accurately calculating distributable profits, you can ensure that you are only distributing dividends that your company can afford.

Once you have confirmed the availability of distributable profits, the next step is to prepare dividend vouchers. Dividend vouchers are legal documents that provide details of the dividends paid to shareholders. These vouchers should include information such as the company name, shareholder’s name, dividend amount, payment date, and signature of an authorized person. By preparing dividend vouchers accurately, you can provide shareholders with a clear record of their dividend payments.

Additionally, documenting board meeting minutes is essential when declaring dividends. Board meeting minutes should reflect the board’s decision to declare dividends, including the amount of dividends, the shareholders receiving dividends, and the payment date. By documenting these decisions in board meeting minutes, you can ensure transparency and compliance with legal requirements.

In summary, when handling dividend payments and tax considerations, it’s crucial to verify the availability of distributable profits, prepare dividend vouchers accurately, and document board meeting minutes effectively. By following these key steps, you can navigate dividend payments and tax considerations successfully while ensuring compliance with legal requirements.

Key Takeaways

When considering dividend payments, it’s crucial to start by confirming the availability of profits to avoid any legal or financial issues. Make sure that your company has distributable profits before proceeding with any dividend payouts. This step is essential for maintaining compliance with regulations and safeguarding the financial health of your business.

Next, it’s important to calculate your tax liability accurately. Understanding dividend tax rates and accurately assessing your tax obligations will help you avoid underpayment or potential penalties. By being diligent in your tax calculations, you can ensure that you meet your obligations and prevent any issues with tax authorities.

Keeping accurate records is another vital aspect of managing dividend payments effectively. Maintain detailed records of board meeting minutes, dividend vouchers, and payment transactions. These records are essential for compliance purposes and can also be valuable during audits or financial reviews.

Seeking professional advice from an accountant is highly recommended when navigating dividend payments and related tax considerations. An accountant can provide guidance on legal requirements, help optimize your tax position, and ensure that you are following best practices in your dividend payment processes.

Lastly, consider using accounting software to streamline your dividend calculations and documentation. Accounting software can help you accurately track profits, dividends, and tax liabilities, making the process more efficient and reducing the risk of errors.

By following these steps and recommendations, you can effectively manage dividend payments and tax considerations for your business, ensuring compliance and financial stability. Remember, proper planning and attention to detail are key to successful dividend management.

Understanding Dividends

Dividends are an essential part of understanding how companies reward their shareholders with a share of the profits. When you invest in a company, dividends represent the income you receive from that investment. Unlike regular income like a salary, dividends are taxed at a different rate, usually lower.

It’s important to note that dividends can only be paid out of a company’s distributable profits, which means the company must have enough profit after tax to distribute. Accurately calculating these profits is crucial to ensure proper dividend distribution.

Dividends should be paid out according to the share structure of the company to ensure fairness among all shareholders. Keeping detailed records of all dividend payments is also vital to avoid any legal issues and maintain transparency in financial transactions.

Issuing Dividends

Issuing dividends is a crucial aspect of managing a company’s financial affairs. Before distributing dividends, it’s essential to ensure that the company has enough distributable profits available after accounting for taxes and other commitments. Begin by examining the company’s financial statements to confirm the availability of sufficient profit for distribution. Once this is established, determine the dividend amount and adhere to the shareholding structure in place.

To issue dividends effectively, prepare a dividend voucher for each shareholder. This document should outline key details such as the dividend amount, payment date, and company information. Additionally, it’s important to document the board meeting minutes where the decision to issue dividends was made.

When making dividend payments, it’s crucial to keep them distinct and separate from employee salaries to prevent any confusion. Maintaining meticulous records of all transactions is vital to ensure compliance and accuracy. Utilizing accounting software can assist in keeping track of financial transactions efficiently.

Regularly reviewing the company’s financial health is essential to uphold compliance standards and avoid the risk of issuing unlawful dividends. By following these guidelines and maintaining a clear record of dividend issuance, companies can effectively manage their financial obligations and uphold regulatory requirements.

Calculating Profits

Understanding how to accurately calculate profits is essential for determining the amount available for dividend distribution within your company. To begin, gather your company’s profit and loss statement for the accounting period.

Subtract the corporation tax liability, which currently stands at 19%. Next, deduct any dividends already paid out during this period. Remember to consider any profit or loss carried forward from previous years.

Utilizing accounting software such as FreeAgent, Xero, or QuickBooks can streamline this process. Ensuring that all figures are up-to-date and precise is crucial, as distributing dividends without sufficient profits can result in legal and financial complications.

Professional Guidance

When you’ve accurately determined your company’s profits, it’s beneficial to seek advice from an accountant to streamline the process of issuing dividends and ensure compliance with legal requirements.

An accountant can assist you in navigating complex regulations, avoiding critical steps. They can also help in maintaining essential documentation for legal and tax purposes.

By leveraging an accountant’s expertise, you can ensure that your dividend payments align with your company’s financial health and meet statutory obligations. Additionally, they can offer insights into optimizing your tax position and avoiding potential pitfalls.

This professional support will save you time, reduce the risk of errors, and allow you to focus on growing your business effectively.

Tax Rates and Records

Understanding the tax rates and record-keeping requirements for dividend payments is essential for financial compliance and strategy optimization. To ensure you meet these obligations, it is crucial to familiarize yourself with the current dividend tax rates for the tax year 2021-22.

Here is a breakdown of the dividend tax rates for this period:

| Income Threshold | Tax Rate | Notes |

|---|---|---|

| Basic Rate (up to £50k) | 7.5% | Applicable to dividends exceeding the allowance |

| Higher Rate (£50k – £150k) | 32.5% | Imposed on substantial dividend amounts |

| Additional Rate (over £150k) | 38.1% | Highest rate for top earners |

Effective record-keeping practices play a significant role in ensuring compliance and avoiding penalties. This includes maintaining accurate records of meetings, creating vouchers, and utilizing reliable accounting software. By adhering to these guidelines, you can navigate the complexities of dividend taxation with ease and confidence.

Conclusion

When it comes to managing dividend payments and tax considerations, it doesn’t have to be a daunting task. The key is to ensure accurate profit calculations, maintain detailed records, and have all the necessary documents prepared. Seeking guidance from an accountant can also be beneficial to stay compliant with tax regulations and optimize your tax position effectively.

To effectively distribute dividends, it’s crucial to have a clear understanding of your profits and expenses. Keeping detailed records of your financial transactions can help track earnings and ensure accurate dividend payments. Additionally, preparing all the necessary documents, such as financial statements and tax forms, is essential for compliance with tax laws.

Professional guidance from an accountant can be invaluable in navigating complex tax considerations and maximizing tax efficiency. They can provide insights on tax-saving strategies and help you make informed decisions when distributing dividends. By following these steps and seeking expert advice when needed, you can effectively manage dividend payments and tax considerations in line with regulations.

💰 Top Financial Offers 💰

📃 MoneyZoe’s Latest Reviews 💰Start saving money with the best financial services

Best Card Readers for Small Businesses and Self-Employed

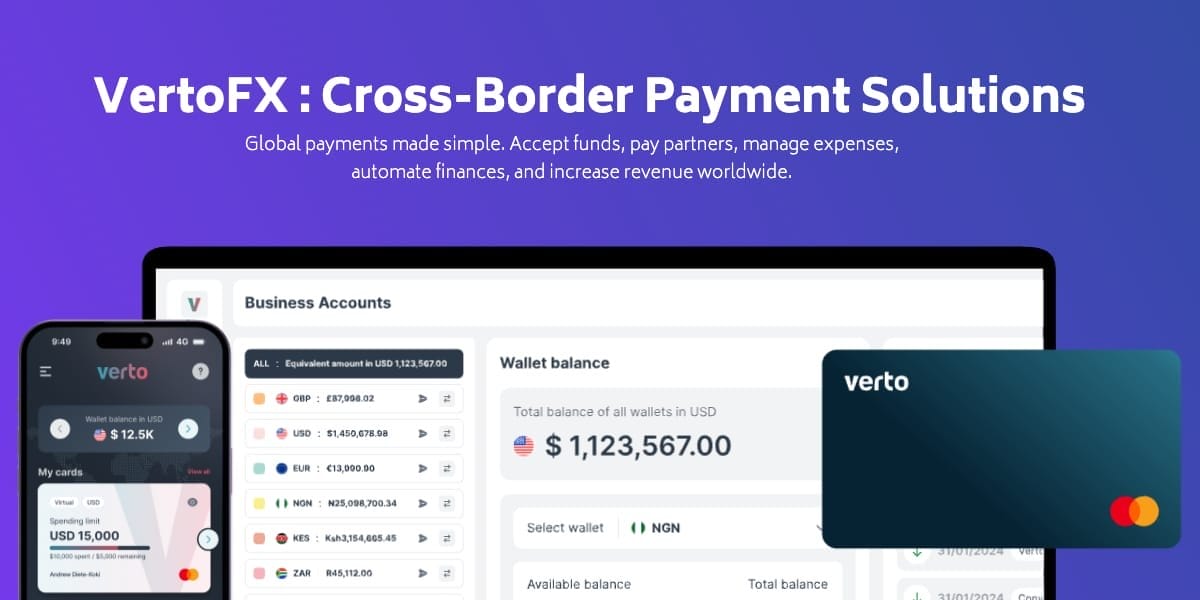

VertoFX Review: Cross-Border Payments for Global Businesses

TallyMoney: The Complete Guide to Gold-Based Banking

SumUp Review: Complete Payment Solutions for Small Businesses

Bolt Business: The All-in-One Solution for Smart Corporate Travel Management