TRASTRA: Transforming Digital Banking with Crypto-Friendly IBAN

by Chris M.

August 2, 2024

by Chris M.

August 2, 2024

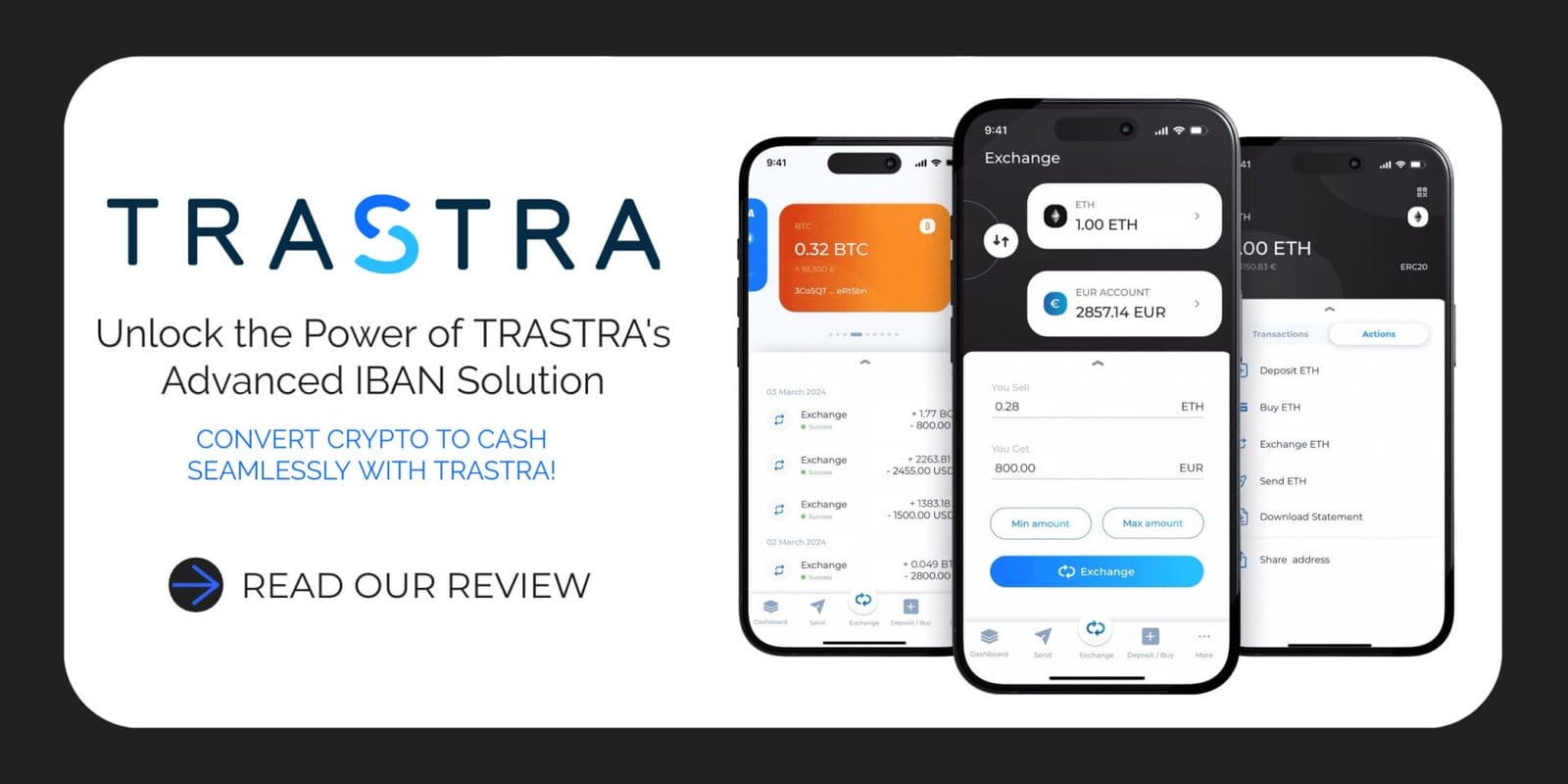

TRASTRA is redefining the digital banking experience by seamlessly integrating cryptocurrency management with traditional banking services. It offers a multi-currency Visa card, IBAN accounts, exchange services, and digital wallets for major cryptocurrencies. This review explores TRASTRA’s features, fee structure, and user experience.

What is TRASTRA?

TRASTRA is a versatile digital banking platform that caters to both cryptocurrency enthusiasts and traditional banking users. The service provides a range of features, including a multi-currency Visa card, the ability to open an IBAN account, cryptocurrency exchange services, and wallets for popular digital assets like Bitcoin (BTC), Ethereum (ETH), and more. It’s particularly notable for allowing users to exchange cryptocurrencies for euros without needing a conventional bank account.

TRASTRA Features

TRASTRA Multi-Currency Wallet

Comprehensive Cryptocurrency Support: TRASTRA supports a wide array of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), XRP, USD Coin (USDC), and Tether (USDT). This extensive support enables users to manage various digital assets within a single platform, making it a convenient choice for those who deal with multiple cryptocurrencies.

Free Wallet: One of TRASTRA’s standout features is its free wallet service, which does not charge for buying, managing, or cashing out cryptocurrencies. This makes it an attractive option for users looking to hold and transact with digital assets without incurring additional costs.

TRASTRA Crypto-Friendly IBAN Account

Receiving Euros with Ease: TRASTRA offers personal IBAN accounts that allow users to receive euros directly. This feature is particularly useful for individuals and businesses that need to handle both fiat and cryptocurrencies, providing a seamless transition between traditional and digital currencies.

Visa Card

Worldwide Acceptance: The TRASTRA Visa card can be used at over 46 million merchants globally, offering users a convenient way to make purchases and pay for services wherever they are. This global acceptance is a significant advantage for travelers and international users.

No Top-Up Fees and Instant Notifications: Loading the Visa card with euros is free, allowing users to spend without worrying about extra charges. Additionally, the platform provides instant notifications for all transactions, and the ability to disable the card instantly adds a layer of security.

Exchange Services

Quick and Easy Conversions: TRASTRA facilitates instant conversion between cryptocurrencies and euros, allowing users to buy, sell, and cash out their digital assets quickly. This feature is particularly useful for those who need immediate access to funds.

No Need for a Bank Account: Users can convert cryptocurrencies to euros without needing a traditional bank account, offering greater financial independence and flexibility.

TRASTRA Business Solutions

Paying Salaries in Crypto: TRASTRA also caters to businesses by enabling them to pay salaries in cryptocurrencies. This feature is particularly beneficial for companies and freelancers operating in the digital economy, providing flexible payment options.

TRASTRA Fees

TRASTRA offers a transparent fee structure, designed to be cost-effective for users. Here’s a detailed breakdown:

- Card Issuance Fee: A one-time fee of 9 EUR.

- Monthly Maintenance Fee: 1.25 EUR per month.

- ATM Withdrawal Fees: 2.25 EUR per withdrawal for domestic transactions (EUR); 2.25 EUR plus 3% for international transactions (non-EUR).

- Card Top-Up Fee: Free.

- Conversion Fees: 1.5% per transaction for both crypto to euro and euro to crypto conversions.

- SEPA Transfer Fees: Incoming transfers are free; outgoing transfers cost 3 EUR.

- Internal Transfer Fees: Free between TRASTRA accounts.

- Card Replacement Fee: 9 EUR.

- Account Inactivity Fee: 5 EUR per month after 12 months of inactivity.

This fee structure is competitive and user-friendly, making it easier for users to manage their finances without unexpected costs.

How Crypto IBANs Work

Crypto IBANs bridge the gap between traditional banking and cryptocurrencies. They enable users to convert digital assets to euros and vice versa with ease. Here’s how it works:

- Convert Crypto to Euros: Cryptocurrencies are sent to an exchange platform, converted at market rates, and the resulting euros are deposited into the user's IBAN account.

- Convert Euros to Crypto: Euros are transferred to the exchange, converted to the chosen cryptocurrency, and deposited into the user's wallet.

TRASTRA’s Partnership with Nuvei

TRASTRA has partnered with Nuvei, a leading payment technology provider, to enhance its banking infrastructure. This collaboration aims to facilitate faster crypto-to-euro conversions and seamless transfers within the Single European Payment Area (SEPA).

New Crypto-Friendly IBAN

- Seamless Transactions: The partnership ensures smooth and fast transactions between fiat and cryptocurrencies.

- Enhanced Security: High security standards are maintained for managing funds.

- Wider Accessibility: Users can easily access their funds across the European Economic Area.

Activating Your TRASTRA Crypto IBAN

To activate your crypto-friendly IBAN, follow these steps:

- Update the App: Ensure that you have the latest version of the TRASTRA app.

- Sign Up or Log In: New users need to sign up, while existing users can log in.

- Navigate to IBAN Section: Locate the IBAN section within the app.

- Activate IBAN: Follow the on-screen instructions to activate your IBAN.

- Start Using: Begin using your IBAN for seamless transactions.

User Reviews and Feedback

Positive Experiences

- Efficient Services: Users frequently praise the ease of converting and using cryptocurrencies.

- Responsive Support: The customer service team is noted for its responsiveness and helpfulness.

Challenges

- Policy Changes: Some users have noted that changes in policies have affected their experience.

- Account Issues: There have been occasional reports of blocked accounts or difficulties accessing funds.

TRASTRA’s User Experience

Easy to Use

- Intuitive App: The TRASTRA app is designed to be user-friendly, making it accessible even for beginners in the world of cryptocurrencies.

- Secure: The app incorporates Two-Factor Authentication (2FA) to enhance security.

Customer Service

- Real People, No Bots: TRASTRA emphasizes personalized customer service, ensuring users interact with real human agents rather than automated bots.

TRASTRA is at the forefront of integrating traditional banking with the growing world of cryptocurrencies. With its comprehensive suite of features, including a crypto debit card, IBAN account, and efficient transaction services, TRASTRA offers a versatile solution for both seasoned crypto users and newcomers. Whether you're looking to manage digital assets, handle traditional currencies, or both, TRASTRA provides a reliable and efficient platform for all your financial needs.

💰 Top Financial Offers 💰

📃 MoneyZoe’s Latest Reviews 💰Start saving money with the best financial services

Card One Money Review 2025: No Credit Check Business Account with Same-Day Setup

MRPeasy Review: Manufacturing Software for Small Businesses

Close CRM Review: Guide to Features, Pricing, and Performance

Flagstone Review 2025: Access 60+ Banks with Rates Up to 4.20% AER

Flagstone Review: Business Savings with High Interest Rates