Wise Business Account: Features, Fees, and Step-by-Step Setup Guide (2024)

by Chris M.

September 11, 2024

by Chris M.

September 11, 2024

For businesses operating internationally, finding cost-effective ways to manage global payments and currencies is essential. This guide explores the Wise Business account, examining its features, costs, and whether it suits your company's needs.

What is Wise Business account?

A Wise Business account functions as your gateway to international banking operations. Developed by Wise (previously known as TransferWise), this digital financial platform enables companies to send, receive, and manage money across borders. Small businesses, online sellers, and international companies use this service to reduce their global transaction costs and simplify their banking operations.

Is Wise a bank?

Despite offering many banking-like services, Wise operates as a financial technology company, not a traditional bank. Financial regulators in multiple countries oversee its operations, ensuring compliance with financial standards. The platform specializes in currency exchange and international transfers rather than traditional banking products like business loans or interest-bearing accounts.

Wise Business account features

Understanding what you get with a Wise Business account helps determine its value for your company. The service combines several essential tools for international business operations.

The account provides these international banking capabilities:

The platform offers comprehensive international banking features:

- Bank accounts in 40+ currencies with local details

- Money transfers to 160+ countries worldwide

- Processing of up to 1,000 payments simultaneously

- Company expense cards for international purchases

- Scheduled payment automation

- Connection options for business software

Wise Business account fees

Money management comes with associated costs. Wise structures its fees differently from traditional banks, focusing on transparency.

The main costs include:

Initial costs:

- Account creation: £60 single payment

- Company cards: £3 each

- Zero monthly fees

Money movement costs:

- Money transfers: Begin at 0.33%

- Cash withdrawal: Free for first £200 monthly

- Extra withdrawals: 1.75% plus £0.50

- Currency switches: Starting from 0.33%

Payment receipt costs:

- Standard transfers: No charge

- US dollar wires: $6.11

- Canadian dollar payments: CAD 10

- International bank transfers: Varies per currency

Wise Business Account for Teams

Companies with multiple employees need efficient expense management solutions. Wise offers specialized tools for team spending control and oversight.

Team expense management includes:

Corporate card distribution:

- Each additional card costs £3

- Set individual spending restrictions

- Monitor purchases in real-time

- First card included with account setup

Account permission settings:

- View-only access for basic monitoring

- Standard access for daily transactions

- Transaction preparation rights

- Payment authorization levels

- Complete administrative control

Additional team benefits:

- Immediate expense updates

- Combined financial reporting

- Money back on qualified purchases

- Shared account supervision

Wise Business Payroll

Processing salaries for international teams requires specialized solutions. Wise simplifies global payroll management through dedicated tools and integrations.

Global payroll solutions include:

Software connections:

- Direct link to Xero platforms

- Tax reporting to government systems

- Automatic calculations

- Streamlined disbursements

Mass payment tools:

- Support for various currencies

- Group payment processing

- Software integration options

- Regular payment scheduling

Financial advantages:

- Standard currency rates

- Minimal processing fees

- Clear cost structure

- Reduced transaction expenses

Compatible payroll systems:

Gusto integration:

- Tax management included

- Base price: $39 plus $6 per worker

- Complete payroll processing

- Employee benefit options

QuickBooks connection:

- Built for growing companies

- Starting from £4 monthly

- Financial software integration

- Tax processing included

Sage compatibility:

- Monthly fee: £7 plus VAT for 5 staff

- Automated pay processing

- Regular compliance updates

- Tax authority reporting

Wise Business account integrations

The platform connects with essential business tools to streamline operations. These connections help automate financial tasks and improve accuracy.

Financial software links:

- Xero for daily transactions

- QuickBooks expense monitoring

- FreeAgent business tracking

Online store platforms:

- Shopify payment processing

- Amazon seller integration

- Custom connection options

Wise business account requirements

Starting a Wise Business account involves specific documentation. These requirements ensure security and regulatory compliance.

Required documents include:

Basic information:

- Working email contact

- Active phone number

- Business registration papers

- Personal identification

- Address verification

- Recent company bank records

Is Wise's Business account safe?

Financial security remains crucial for online banking platforms. Wise implements extensive protection measures for business transactions.

Protection includes:

- Government financial oversight

- Multi-step verification processes

- Protected data transmission

- Separate client funds

- Regular system checks

- Active fraud detection

Wise Business customer reviews

Actual user experiences reveal the practical benefits and limitations of Wise Business services. Customer feedback provides valuable insights for potential users.

Customers praise:

- Quick international money movement

- Simple fee explanations

- Easy system navigation

- Quick support responses

- Dependable service delivery

Improvement areas include:

- Account setup duration

- Specific currency conversion costs

- Cash transaction limitations

How to open a Wise Business account

Creating an account follows specific steps designed for security and proper setup. Complete these actions to begin using Wise Business:

- Select Business account on Wise website

- Provide company registration information

- Upload identity verification documents

- Wait for account verification

- Complete initial account payment

- Begin international transactions

Pros and cons of Wise Business

Understanding both advantages and limitations helps make informed decisions about using Wise Business services.

Key advantages:

- Lower international transfer expenses

- Multiple currency management

- Business software compatibility

- Strong protection measures

- Straightforward pricing

Important limitations:

- No traditional banking services

- No lending options

- Limited cash operations

- Some currency restrictions

Wise business account supported countries

Wise Business maintains extensive global coverage. The service operates in more than 80 nations, including major markets across North America, Europe, and Asia-Pacific regions. Businesses can send money to over 160 countries worldwide.

Wise Business Account: Is it right for your business needs?

Selecting appropriate financial services requires careful evaluation of your business operations and requirements.

Best suited for companies that:

- Handle regular international payments

- Work with multiple currencies

- Require accounting system integration

- Want to reduce exchange costs

- Operate in supported regions

Consider other options if you need:

- Standard banking services

- Business financing

- Regular cash transactions

- Domestic-only banking

Wise Business vs Personal

Understanding differences between account types helps choose the right option. Business and Personal accounts serve distinct purposes with different features.

Main differences:

- Group payment tools in Business accounts

- Team management capabilities

- Software integration access

- Different fee structures

- Additional verification steps

Wise Business alternatives

Several financial services offer similar international business solutions. Each option provides unique benefits and features.

Key competitors include:

Revolut Business offerings:

- Complete digital banking

- Staff expense tools

- Digital payment cards

- Market investment options

Payoneer services:

- Global payment systems

- Online marketplace tools

- Freelance payment options

- Bulk payment processing

OFX capabilities:

- High-value transfer focus

- Individual client service

- Volume-based pricing

- Currency protection tools

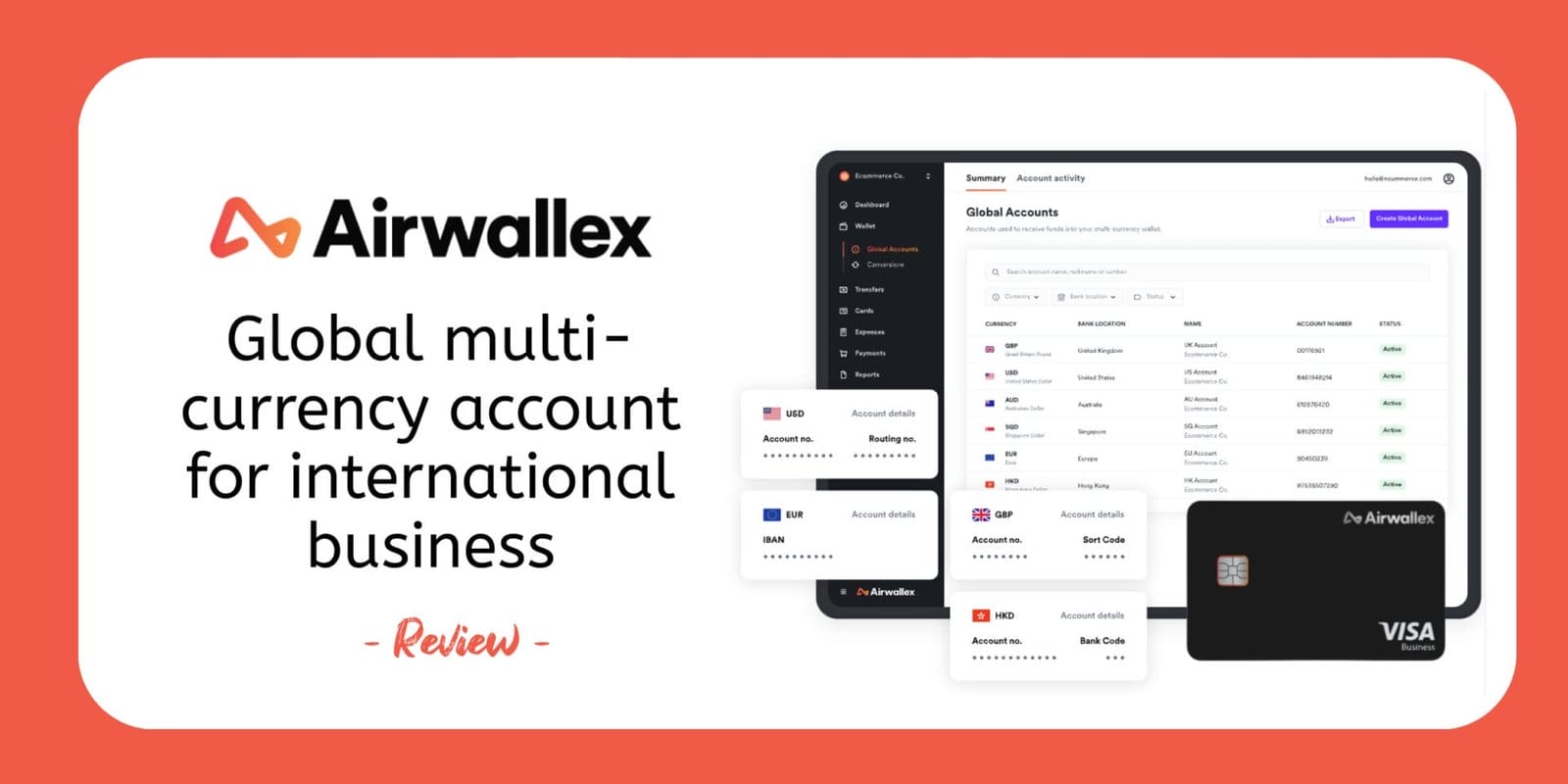

Airwallex platform:

- Business banking tools

- Automated payments

- Currency accounts

- System connections

Having multiple business accounts offers flexibility in managing your finances. While Wise excels at international transactions, maintaining an additional account with a traditional bank can provide complementary services for local banking needs. This combination allows businesses to use each account's strengths effectively.

For more options on business banking solutions, explore our detailed comparison of the best business bank accounts.

💰 Top Financial Offers 💰

📃 MoneyZoe’s Latest Reviews 💰Start saving money with the best financial services

Airwallex Demo Account: See How Airwallex Works

Best Card Readers for Small Businesses and Self-Employed

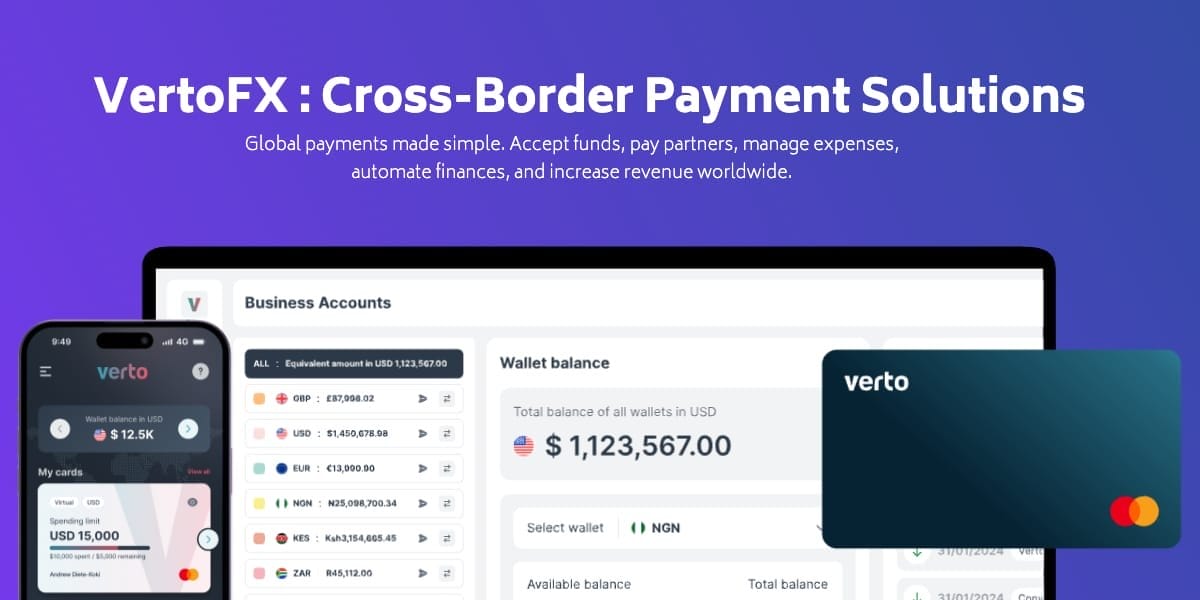

VertoFX Review: Cross-Border Payments for Global Businesses

TallyMoney: The Complete Guide to Gold-Based Banking

SumUp Review: Complete Payment Solutions for Small Businesses