Today is possible to get B&Q cashback and turn your home improvement and garden retailer expenses into savings by earning cashback on each purchase!

B&Q is a leading home improvement and garden retailer in the UK. Whether you’re looking to revamp your garden with a new lawnmower or need a power drill for your DIY tasks, B&Q offers a comprehensive range of products to cater to all your home and garden needs. With its commitment to quality and affordability, B&Q has become the go-to destination for homeowners and DIY enthusiasts alike.

How the Suits Me® Cashback Works at B&Q

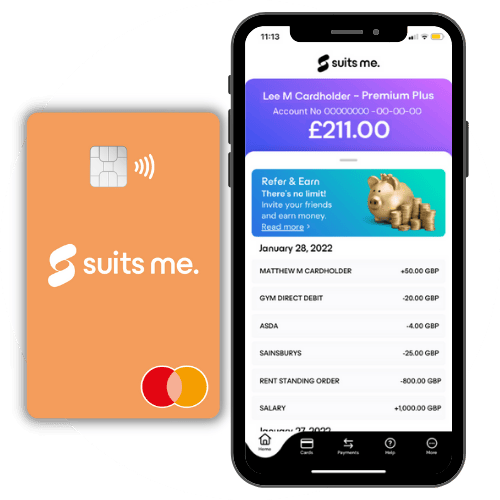

Shopping at B&Q with your Suits Me® card is not just about buying products; it’s about earning while you spend. Every time you use your Suits Me® debit card, either in-store or online at B&Q, 4% of your total spend is credited back to your Suits Me® account as cashback. This means that for every purchase, you’re essentially getting a discount, making your shopping experience even more rewarding.

Maximizing Your Savings

The average household, according to Money Helper, spends significant amounts on home improvements and essentials. By using the Suits Me® card at B&Q, you can make considerable savings over time. And it’s not just B&Q; the Suits Me® cashback rewards extend to various other partner stores and services, ensuring you save wherever you shop.

Suits Me® Card and his benefits

Suits Me® provides a variety of advantages for its members:

- Instant access to a UK account with no credit check

- Free Contactless Debit Card and mobile app

- Cashback Rewards: Earn cashback every time you shop using the Suits Me® card.

- Multi-lingual Customer Care: Assistance available in 11 different languages.

- Refer & Earn: Refer friends to apply and use their Suits Me® card and earn £25 per friend. There’s no limit to the number of friends you can refer.

Suits Me® E-Money Accounts: How to choose Your Account

Suits Me® offers three distinct e-money account types, each tailored to meet varying customer needs. Here’s a breakdown of each account type and their differences:

Essential Account:

- Type: Pay as you go.

- Monthly Management Fee: None.

- Features: This account is for those who prefer a no-commitment, pay-as-you-go plan, with £1.25 per local transfer in, free standing order setup, and exclusive discounts from top brands.

Premium Account:

- Type: Monthly subscription.

- Monthly Management Fee: £4.97.

- Features: The Premium account comes with a monthly fee, while local transfers in and standing order setup are free. It also offers exclusive top-brand discounts and cashback on spending at popular partners including Argos, Asda, B&Q, Goldsmiths, Footlocker, New Look, Sainsbury’s, and more.

Premium Plus Account:

- Type: Monthly subscription with added benefits.

- Monthly Management Fee: £9.97.

- Features: The Premium Plus account comes with a monthly fee, while local transfers in and standing order setup are free. It also offers exclusive top-brand discounts, cashback at partners including Argos, Asda, B&Q, Goldsmiths, Footlocker, New Look, Sainsbury’s, and more, and VIP Queue Jump.

YOUR GUIDE TO SETTING UP A SUITS ME ACCOUNT

Opening an account with Suits Me is a straightforward and quick process that can be completed online in under 10 minutes. To apply for a Suits Me e-money account, you will need an accepted ID document (either a valid Passport, full UK Driving Licence, or National ID Card if you are an EU resident), a UK address, and to be aged 18 or over.

Enter your personal details

Embarking on your journey with Suits Me is straightforward. Begin by providing basic information like your title, first name, surname, and email address.

Select the account type most suited to your needs

Essential, Premium or Premium Plus account

Verify your identity by completing a live selfie and uploading your ID.

Either a valid Passport, full UK Driving Licence or National ID Card if you are an EU resident

Submit your application and wait for your application to be processed and check your email to see if you have been accepted.

Once completed, you will receive a contactless Mastercard® debit card and have access to the online money account and mobile app.

Before starting the application, ensure you have:

- An accepted ID document (valid Passport, full UK Driving Licence, or National ID Card if you are an EU resident).

- A UK address.

- You must be aged 18 or over.

Beyond Home Improvements: Suits Me® Cashback Partners

While B&Q is a fantastic place for all your home and garden needs, the Suits Me® card’s benefits don’t stop there. Whether you’re buying trainers, dining out, or shopping for groceries, using the Suits Me® card ensures you’re always earning. Every transaction becomes an opportunity to save.

- Argos Cashback

- Asda Cashback

- B&Q Cashback

- Bella Italia Cashback

- Café Rouge Cashback

- Carpetright Cashback

- Clarks Cashback

- Foot Locker Cashback

- Las Iguanas Cashback

- Halfords Cashback

- JoJo Maman Bebe

- Laithwaite’s Wines Cashback

- New Look Cashback

- Sainsbury’s Cashback

- Storey Carpets Cashback

- Virgin Experience Days Cashback

- Yo! Sushi! Cashback