FreshBooks: The Ultimate Accounting Solution for Small Businesses and Freelancers

by Chris M.

August 28, 2024

by Chris M.

August 28, 2024

FreshBooks is a cloud-based accounting solution designed with small business owners, freelancers, and self-employed professionals in mind. Its user-friendly interface and comprehensive suite of features make it a popular choice for those who need efficient financial management tools. Here’s an in-depth look at what FreshBooks offers and how it can benefit different types of users.

Key Features of FreshBooks

FreshBooks stands out for its robust set of features tailored to the needs of small business owners and freelancers. Here’s a closer look at the key functionalities:

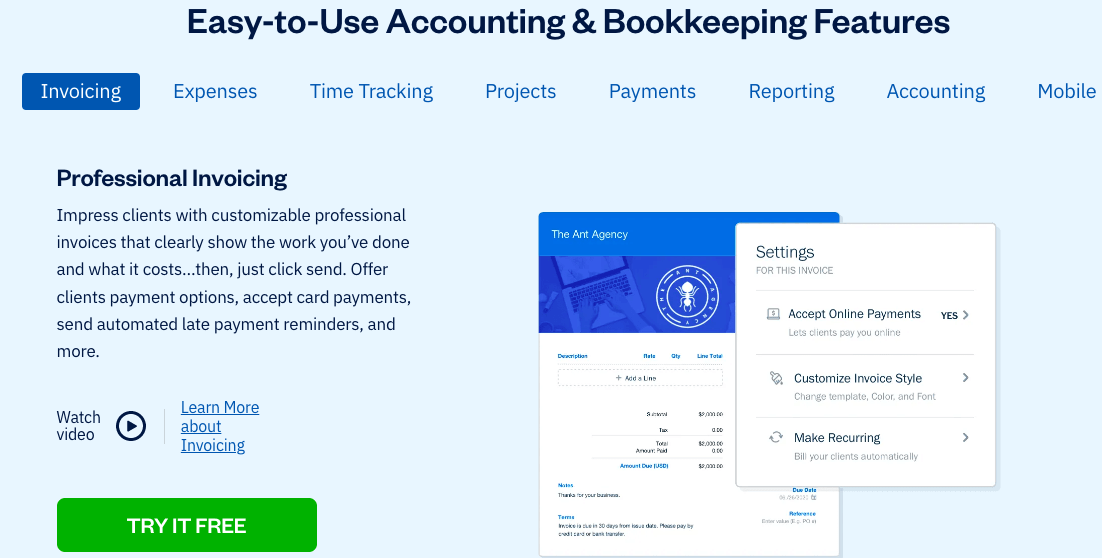

FreshBooks Invoicing

FreshBooks simplifies the invoicing process with its intuitive tools:

- Customizable Templates: Users can design invoices that reflect their brand by adding logos and choosing from various templates.

- Automated Reminders: The software sends automatic reminders for overdue invoices, reducing the hassle of follow-ups.

- Direct Emailing: Invoices can be sent directly to clients via email, streamlining the payment process.

Time Tracking

FreshBooks includes a built-in time tracking feature:

- Billable Hours: Track hours spent on projects and clients to ensure accurate billing.

- Multi-Device Access: Time tracking is available on both desktop and mobile devices, allowing users to log hours from anywhere.

- Integration with Invoices: Convert time entries into invoices with a few clicks, making billing straightforward.

Expense Tracking

Managing expenses is made easy with FreshBooks:

- Receipt Uploads: Users can upload photos of receipts, and FreshBooks will automatically categorize them.

- Expense Categorization: The software organizes expenses into categories, aiding in tax preparation and financial analysis.

Project Management

FreshBooks offers tools for effective project management:

- Task Tracking: Set up projects, assign tasks, and monitor progress to keep projects on track.

- Deadline Management: Track deadlines and manage team contributions to ensure timely project completion.

Financial Reporting

Generate detailed financial reports with FreshBooks:

- Real-Time Reports: Access profit and loss statements, balance sheets, and cash flow statements to get an overview of your business’s financial health.

- Customizable Reports: Tailor reports to specific time periods, income streams, and expense categories for in-depth analysis.

Payment Processing

FreshBooks supports various payment methods:

- Integration with Payment Gateways: Accept online payments through credit cards, PayPal, and other payment methods.

- Automatic Payment Reminders: Set up automatic reminders to prompt clients about upcoming or overdue payments.

Mobile App

The FreshBooks mobile app enhances flexibility:

- Access on the Go: Manage your account, send invoices, and track expenses from your iOS or Android device.

VAT and Sales Tax Reporting

FreshBooks provides tailored features for tax reporting based on regional needs:

VAT Reporting (UK)

For businesses registered for VAT in the UK:

- Automatic VAT Calculation: Set VAT rates, and FreshBooks will calculate VAT on invoices and expenses.

- VAT Summary Reports: Generate detailed VAT reports to simplify submission to HM Revenue and Customs (HMRC).

Sales Tax Reporting (US)

For businesses in the US:

- Sales Tax Tracking: Set up and monitor sales tax rates according to state and local jurisdictions.

- Sales Tax Reports: Generate reports showing the amount of sales tax collected, aiding in accurate state and local tax filings.

FreshBooks Pricing Plans

FreshBooks offers several pricing plans to accommodate various business needs. Currently, there’s a special promotion offering 90% off for the first three months, plus an additional 10% off the annual subscription. Here’s a breakdown of the available plans:

Lite Plan

- Ideal For: Solo entrepreneurs or small businesses just starting out.

- Features:

- Unlimited invoicing to up to 5 clients.

- Expense tracking and sales tax management.

- Access via iOS and Android.

- VAT return filing feature for UK businesses.

Plus Plan

- Ideal For: Growing small businesses with a larger client base.

- Features:

- Unlimited invoicing to up to 50 clients.

- Automated expense tracking and recurring billing.

- Access to business health reports and double-entry accounting.

- VAT return filing for UK businesses.

Premium Plan

- Ideal For: Expanding businesses needing advanced features.

- Features:

- Unlimited invoicing and client management.

- Advanced project tracking and custom email templates.

- Lower transaction caps and automatic reminders for late payments.

- Includes all features of the Plus Plan.

Custom Plan

- Ideal For: Businesses with unique needs and complex billing requirements.

- Features:

- Unlimited invoicing and team member accounts.

- Dedicated account manager and custom onboarding.

- Ability to remove FreshBooks branding from client communications.

- Comprehensive financial and accounting reports.

Conclusion

FreshBooks is a powerful tool for managing finances, offering a range of plans to fit various business needs. The Premium Plan, in particular, provides extensive features and the best value for businesses requiring advanced accounting tools. With the current promotional discount, it’s a great opportunity to experience FreshBooks’ capabilities. All plans come with a 30-day free trial, allowing users to explore the software risk-free.

Whether you’re a freelancer, small business owner, or self-employed professional, FreshBooks can help streamline your accounting processes and enhance your financial management.

💰 Top Financial Offers 💰

📃 MoneyZoe’s Latest Reviews 💰Start saving money with the best financial services

Card One Money Review 2025: No Credit Check Business Account with Same-Day Setup

MRPeasy Review: Manufacturing Software for Small Businesses

Close CRM Review: Guide to Features, Pricing, and Performance

Flagstone Review 2025: Access 60+ Banks with Rates Up to 4.20% AER

Flagstone Review: Business Savings with High Interest Rates