What is Tide Business Account?

Tide Business Account is a cutting-edge financial platform designed specifically for UK-based small and medium-sized businesses, freelancers, and sole traders. Unlike traditional banks, Tide offers a fully digital experience, allowing you to manage your finances easily through their mobile app or online platform.

Key Features of Tide Business Account

Easy Account Setup

Opening a Tide Business Account is quick and straightforward. Simply provide your business details and personal information, and you can have your account up and running in no time. Say goodbye to lengthy paperwork and waiting periods.

No Monthly Fees

One of the most appealing aspects of Tide Business Account is that many of their plans come with no monthly fees. This cost-effective solution is perfect for businesses looking to minimize their banking expenses.

Seamless Integration with Accounting Software

Tide Business Account integrates with popular accounting tools such as Xero, QuickBooks, Sage, and more. This integration allows for automatic transaction feeds, making bookkeeping and financial reporting a breeze.

Real-Time Account Management

With Tide’s mobile app, you can access your account balances and transaction history in real-time. This feature enables you to stay on top of your cash flow and make informed financial decisions on the go.

Invoicing and Payment Scheduling

Tide Business Account simplifies your invoicing process. Create and send professional invoices directly from the platform, and schedule payments to your suppliers to ensure timely transactions.

Free Tide Mastercard

As a Tide Business Account holder, you’ll receive a free Tide Mastercard for your business expenses. You can easily freeze and unfreeze your card through the app if it’s lost or stolen, giving you added security and peace of mind.

24/7 Customer Support

Tide offers dedicated customer support for their business account holders. Whether you have a question or encounter an issue, you can reach out to their team via phone, email, or chat, any time of the day or night.

Tide Business Account Eligibility

To be eligible for a Tide Business Account, you must be a UK resident with a registered business in the UK. This account is ideal for:

- Small business owners (Limited Companies)

- Freelancers

- Sole traders

How to Open a Tide Business Account

- Visit the Tide website or download the Tide mobile app.

- Provide your business name, registration number, and address.

- Enter your personal details as the account holder.

- Submit a photo ID, such as a passport or driving license, for verification.

The account opening process is quick and can be completed online within minutes.

Tide Business Account Pricing

Tide offers four different business account plans to match various business needs and budgets. Each plan provides different features and transaction limits, allowing businesses to choose the option that works best for their operations.

The available account options include:

- Tide Free Account Plan – Essential banking services without monthly fees

- Tide Smart Account Plan – £12.49 per month plus VAT for growing businesses

- Tide Pro Account Plan – £24.29 per month plus VAT for established companies

- Tide Max Account Plan – £69.99 per month plus VAT for high-volume operations

The Free Account Plan works well for startups and small businesses with basic banking needs. Paid plans offer more features, higher transaction limits, and additional business tools. All paid plans include VAT charges and provide access to premium features like accounting software connections and expense management tools. This setup helps businesses pick the right plan for their current needs and upgrade when they grow.

Tide Free Account

Tide Smart Account

Tide Pro Account

Tide Max Account

Though some services, such as international payments, cash withdrawals, and card replacements, may incur additional charges, Tide’s transparent pricing structure ensures you know exactly what to expect.

Is Tide Business Account Right for Your Business?

Tide Business Account offers a range of benefits that cater to the needs of small and medium-sized businesses:

Time-Saving Features

With seamless accounting integrations, real-time account management, and invoicing capabilities, Tide Business Account helps you save time on financial administration, allowing you to focus on growing your business.

Cost-Effective Solutions

Tide’s free account plan and competitive pricing make it an affordable choice for businesses looking to minimize their banking costs without compromising on features and services.

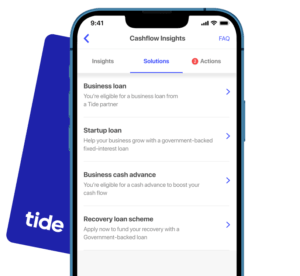

Improved Cash Flow Management

Real-time account balances, transaction history, and expense categorization features enable you to stay on top of your cash flow and make informed financial decisions.

Enhanced Security

Tide’s app allows you to freeze and unfreeze your Mastercard instantly, providing an extra layer of security for your business expenses.

Convenient Digital Banking

With Tide’s mobile app and online platform, you can manage your finances anytime, anywhere, eliminating the need for physical branch visits.

Drawbacks to Consider

While Tide Business Account offers numerous benefits, there are some limitations to keep in mind:

Limited Banking Services for Large Businesses

Tide’s features are tailored for small and medium-sized businesses. Larger enterprises with more complex banking needs may require additional services not currently offered by Tide.

Charges for Certain Services

Although Tide offers competitive pricing, some services, such as transfers, cash deposits, and international payments, may incur fees. Be sure to review the pricing structure to understand the costs associated with your business’s specific needs.

Tide Business Account for Content Creators and YouTubers

Content creators and YouTubers can also benefit from Tide Business Account. The platform’s features, such as real-time account balances, transaction history, invoicing, and accounting software integration, make it easier for content creators to manage their income and expenses.

Using Tide Debit Card Abroad

Tide Mastercard debit cards can be used when traveling abroad. However, it’s essential to note that foreign currency transactions and cash withdrawals may incur additional charges.

Tide Credit Builder for Businesses

Tide Credit Builder is a unique feature designed to help small businesses grow their creditworthiness. By making 12 monthly payments (principal + interest) to Tide Credit Builder, businesses can demonstrate their lending potential to Credit Reference Agencies such as Experian.

Eligibility for Credit Builder:

- Limited companies incorporated for less than 2 years

- No CCJ raised against the business in the last 6 years

Tide business account Pros & Cons

Conclusion

In summary, Tide Business Account offers a comprehensive and cost-effective solution for small and medium-sized businesses looking to simplify their financial management. With features like easy account setup, seamless accounting integrations, real-time account management, and 24/7 customer support, Tide empowers business owners to take control of their finances and focus on what matters most – growing their business.

Whether you’re a freelancer, sole trader, or small business owner, Tide Business Account can help streamline your financial processes, save you time and money, and provide the support you need to thrive in today’s competitive business landscape.

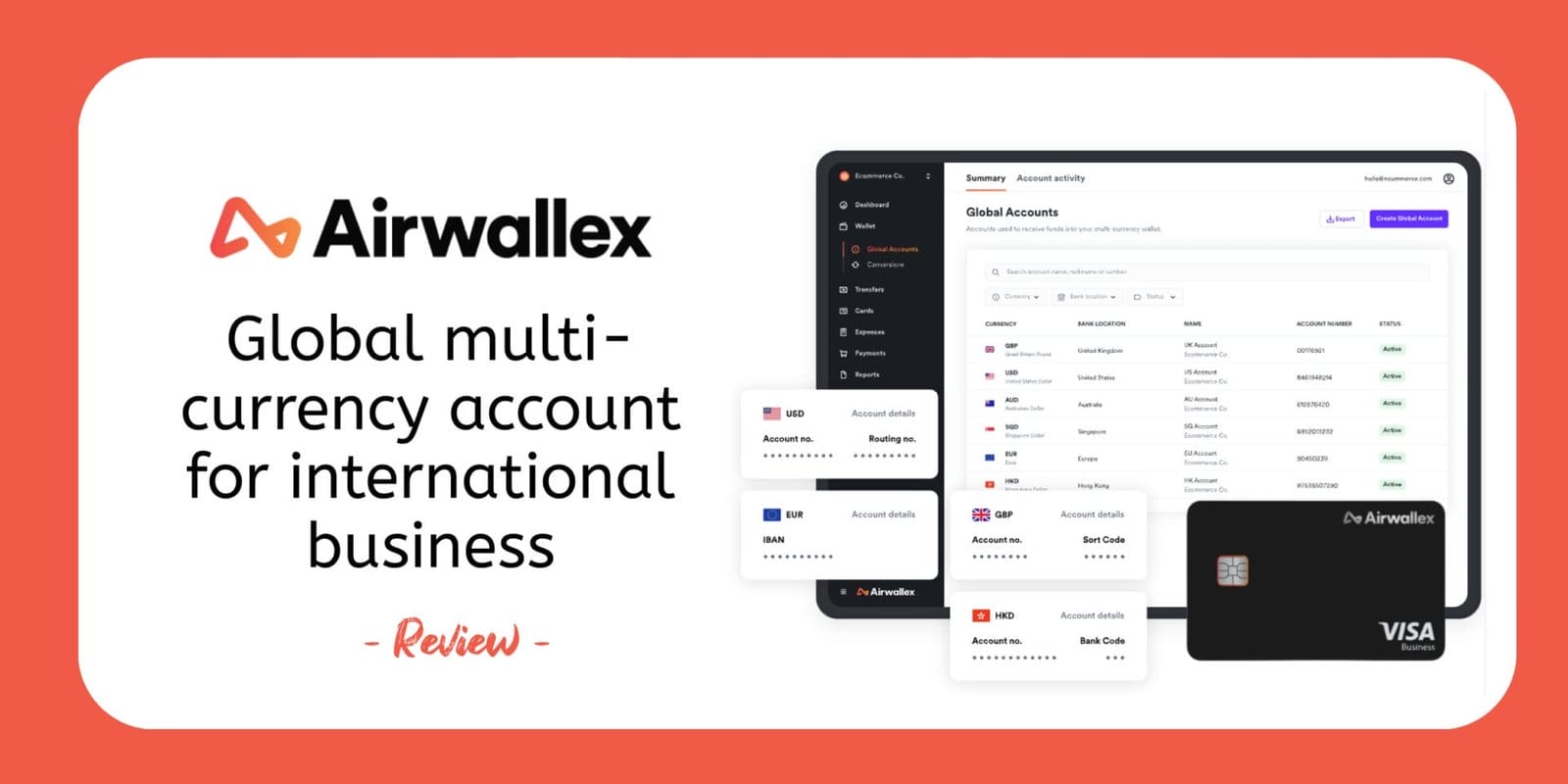

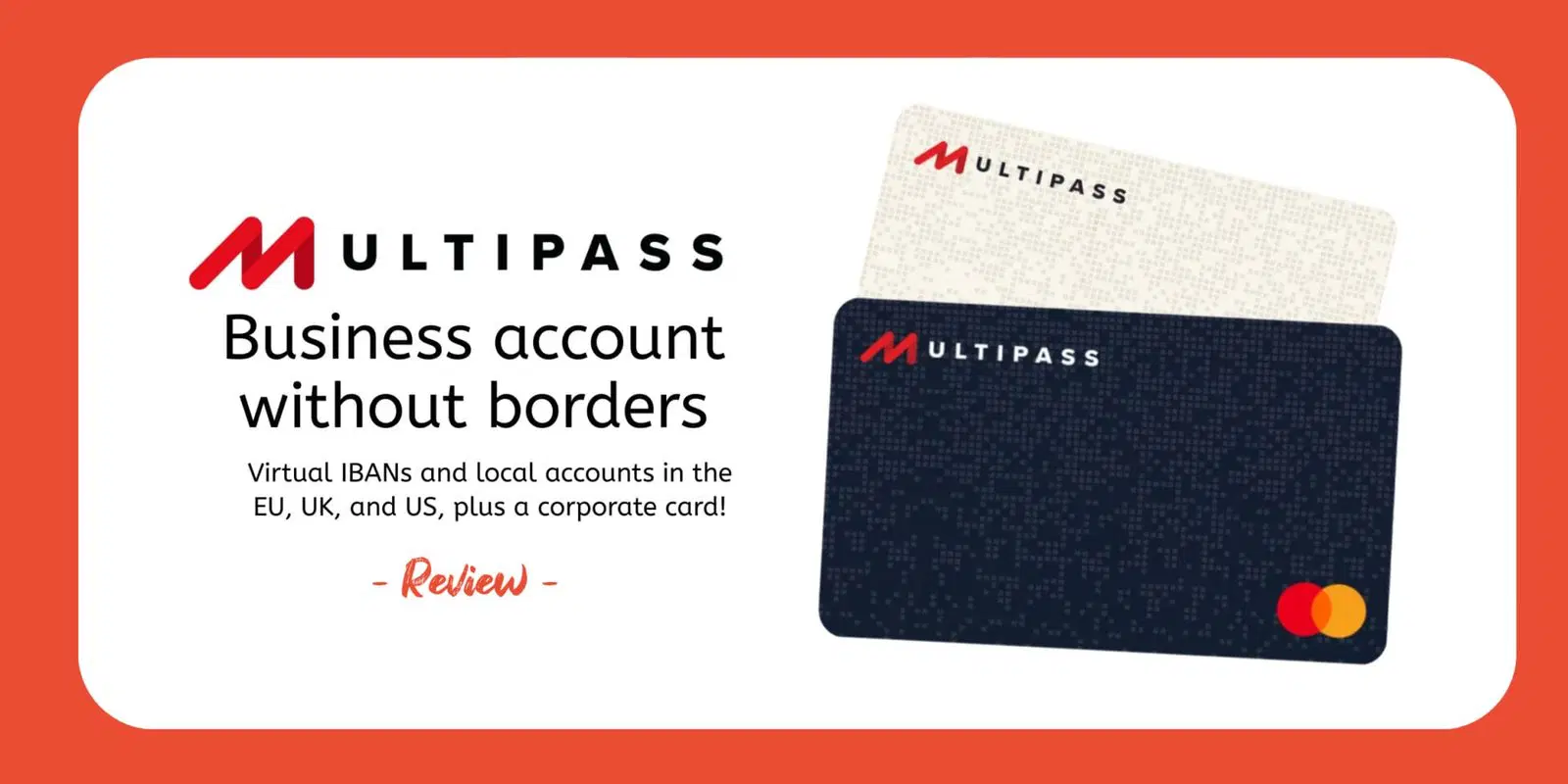

Tide Business Account Alternatives

Countingup

Ampere

Wise Business Account

Anna Money

Pleo Card

Unlock the potential of your business with the right banking partner. Our in-depth guide to the Best Business Bank Accounts showcases top-tier options designed to meet your specific requirements. Explore a range of accounts suitable for businesses of all sizes, and compare key features to find the perfect fit. From seamless integration with accounting software to competitive rates and dedicated support, discover the ideal account to streamline your finances and fuel your business’s growth. Take control of your business banking today and find the account that empowers your success.